"Comparative Analysis of Financial Performance between Conventional and Islamic Banking" is a significant topic that examines how both banking models perform financially, based on key metrics, operational structure, and underlying principles. Here's a structured outline to guide your research or presentation:

1. Introduction

- Objective: To compare the financial performance of conventional and Islamic banks.

- Rationale: Differences in their operational models (interest-based vs. Shariah-compliant) could influence profitability, stability, and efficiency.

- Scope: Could focus on one country (e.g., Malaysia, GCC, Indonesia) or compare across regions.

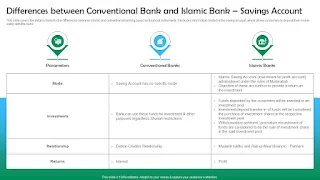

2. Fundamental Differences

Conventional Banking:

- Operates on interest-based lending.

- Profit from the spread between deposit and lending rates.

- Investments may include non-ethical industries (e.g., alcohol, gambling).

Islamic Banking:

- Prohibits riba (interest), gharar (uncertainty), and haram (prohibited) activities.

- Uses profit-loss sharing (Mudarabah, Musharakah), sale-based (Murabaha), and lease-based (Ijarah) contracts.

- Emphasizes ethical investment and asset-backing.

3. Key Financial Performance Metrics

You may use CAMEL or similar frameworks to structure the comparison:

4. Comparative Analysis: Key Findings from Literature

- Profitability: Conventional banks may show higher short-term profitability due to interest-based lending, while Islamic banks sometimes perform better in risk-adjusted returns.

- Stability: Islamic banks have shown greater resilience during financial crises due to asset-backing and lower exposure to speculative markets.

- Liquidity Management: Conventional banks have more liquidity instruments; Islamic banks face limitations due to Shariah constraints.

- Efficiency: Conventional banks generally show higher operational efficiency, though some Islamic banks are closing the gap with digital innovation.

- Growth and Outreach: Islamic banking is expanding rapidly in Muslim-majority countries and gaining traction globally.

5. Case Study / Empirical Analysis (Optional Section)

If you’re doing a data-based paper:

- Sample: Choose a sample of Islamic and conventional banks from the same region.

- Time Frame: e.g., 5 years of financial data.

- Methodology: Use financial ratios, regression models, or panel data analysis.

- Findings: Highlight strengths and weaknesses of both models based on empirical results.

6. Challenges in Comparison

- Different Business Models: Not all ratios are directly comparable.

- Lack of Standardization: Varying financial reporting standards in Islamic finance.

- Market Maturity: Islamic banks are often newer and smaller in scale.

7. Implications and Recommendations

- For Regulators: Need to create fair, Shariah-compliant risk and liquidity frameworks.

- For Investors: Understanding the ethical and long-term value proposition of Islamic banking.

- For Banks: Learn cross-model best practices in risk management and technology adoption.

8. Conclusion

Both conventional and Islamic banks have unique strengths. While conventional banks may outperform in efficiency and scalability, Islamic banks contribute to financial stability and ethical finance. A blended approach to financial innovation and Shariah compliance may lead to a more resilient banking ecosystem.