"The Role of FinTech in the Growth of the Islamic Financial Industry" explores how financial technologies are transforming Islamic finance by enhancing efficiency, accessibility, and compliance with Shariah principles. Here’s a structured overview you can use for a paper, presentation, or research report:

1. Introduction

- Definition of FinTech: The integration of technology into financial services to improve and automate the delivery and use of financial products.

- Overview of Islamic Finance: A Shariah-compliant financial system emphasizing ethical investments, risk-sharing, and prohibition of interest (riba).

- Intersection Point: FinTech and Islamic finance both aim to democratize access to financial services and promote ethical practices.

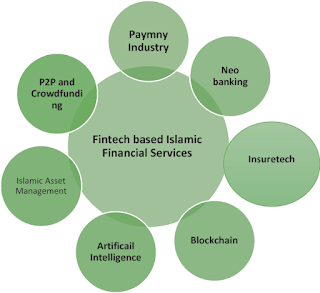

2. Key Areas of FinTech Impact in Islamic Finance

a. Digital Banking

- Shariah-compliant digital banks (e.g., Insha, Albaraka Turk Digital).

- 24/7 access, lower operational costs, and improved financial inclusion.

b. Crowdfunding Platforms

- Islamic equity-based crowdfunding (e.g., Ethis, Blossom Finance).

- Supports SMEs and social enterprises under Mudarabah and Musharakah contracts.

c. Peer-to-Peer (P2P) Lending

- Shariah-compliant P2P using risk-sharing instead of interest-bearing loans.

- Facilitates direct financing for individuals and micro-businesses.

d. Blockchain and Smart Contracts

- Enables transparent and immutable contracts for Islamic financial products.

- Smart contracts can automate sukuk payments and zakat distribution.

e. Robo-Advisory and Wealth Management

- Automates halal portfolio management.

- Helps investors identify Shariah-compliant assets and optimize portfolios using AI.

f. InsurTech (Takaful)

- Tech-driven solutions for Takaful (Islamic insurance).

- Enhances transparency and efficiency in claims management and underwriting.

3. Benefits of FinTech to Islamic Finance

- Enhanced Financial Inclusion: Reaches unbanked populations in OIC countries.

- Improved Transparency: Through blockchain and automated compliance checks.

- Greater Efficiency: Lower costs, faster transactions, and scalable services.

- Customized Products: AI and big data enable personalization while adhering to Shariah.

4. Challenges

- Shariah Compliance: Ensuring new technologies uphold Islamic principles.

- Regulatory Uncertainty: Inconsistent FinTech regulations across countries.

- Cybersecurity Risks: As digitalization increases, so does vulnerability.

- Lack of Awareness and Skills: Especially in developing Islamic markets.

5. Regulatory and Strategic Recommendations

- Develop Unified Shariah and FinTech Standards.

- Promote Regulatory Sandboxes to test Shariah-compliant FinTech.

- Invest in Human Capital through FinTech education in Islamic finance institutions.

- Public-Private Partnerships to fund FinTech innovation in Islamic finance.

6. Case Studies

- Ethis (Malaysia/Indonesia) – Shariah-compliant crowdfunding for real estate and social impact projects.

- Al Yusr (Saudi Arabia) – Robo-advisory for Islamic investment portfolios.

- ADGM (Abu Dhabi Global Market) – FinTech sandbox supporting Islamic startups.

7. Conclusion

FinTech is a powerful enabler of growth in the Islamic financial industry. By leveraging digital innovation while upholding Shariah principles, Islamic FinTech can broaden access to ethical finance, stimulate economic growth, and improve financial inclusion across Muslim-majority and global markets.